Businesses battle economic fallout from COVID-19

By KOLTON FISHBACK, Student Reporter

Geoff Clark, the CEO of Value Added Products in Alva, was worried about how the coronavirus could affect his business. He began to understand the pandemic at the beginning of March, and workers at his company focused on protecting their health – and their employment.

“In the face of the pandemic, I could not bring myself to putting them on the streets with no health benefits,” Clark said.

When the coronavirus pandemic began, it quickly changed how people complete tasks in their day-to-day lives. The virus was unexpected, and weeks later, it was rapidly spreading throughout the United States. The spread eventually caused schools to shut down, businesses to close, and sport events to be canceled to ensure the public’s safety.

The pandemic affected Alva’s business sector. In some instances, businesses or companies were forced to shut down or change their hours in response to the virus.

Clark said his employees are the most important assets at Value Added Products. On March 15, the company started checking the temperatures of all employees upon their arrival to work.

The company also required employees to wear masks, wash their hands frequently, and clean the factory’s equipment every three hours.

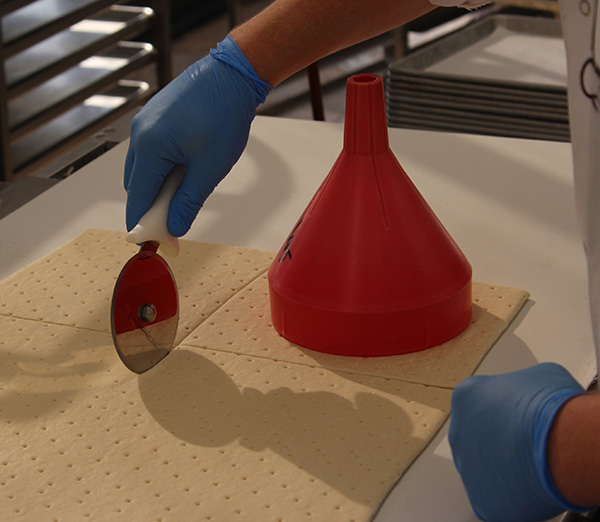

Value Added Products was established in 1999. The company is an Oklahoma farmer-owned cooperative that produces premium food products with farmers’ crops, Clark said.

Value Added Products partners with more than 800 farmers across America. The company is known for making pizza crust and other types of bread products that are available nationwide.

Godfather’s Pizza, U.S. Foods and Alpha Food Co. are some of the company’s business partners, Clark said.

Clark said 85% of the company’s business was affected because of the virus when schools, restaurants and casinos closed down. Clark said the pandemic also impacted pizza toppers, meat manufacturers and distribution companies because they were stuck with inventory and had nowhere to ship it.

The company went through two rounds of furloughs and had to close for a period of time because it had no product orders. Clark resorted to a furlough rather than a layoff because he wanted his employees back, he said.

CHURCHES IMPACTED, TOO

Chris Ruwaldt, pastor of the First Baptist Church, said he believes his church is doing well.

“We were pretty well prepared for it, honestly, Ruwaldt said. “The only thing we had to do was make sure people got the news that we were not going to meet physically.”

The church’s attendance levels have been lower since the pandemic began, Ruwaldt said.

Ruwaldt does not require parishioners to wear masks during church sessions. Church leaders have made minor adjustments to certain aspects of the worship services. Ruwaldt said people are fearful about the situation and want to wait things out.

ONLINE BANKING BECOMES POPULAR OPTION

Kim Baugh, a compliance officer at BancCentral, said the bank is serving customers in different ways because of the pandemic.

Customers have always had the option of using online banking, and BancCentral has developed a new product called E-sign. The product allows customers to sign documents electronically and securely, Baugh said. Customers can then complete their banking via email.

“While COVID has been challenging for us, it’s also been a really exciting time,” Baugh said.

Baugh said the workload for bank employees has remained consistent. She said employees have had additional work because of the CARES Act and related stimulus packages. Employees have processed different types of loans through the federal government. The Paycheck Protection Program, designed to help small businesses pay their employees amid the economic downturn, has required bank employees to do extra work, she said.

The bank’s employees are using hand sanitizer, wearing face masks and gloves and cleaning the bank frequently because they handle money, Baugh said. Customers may wear masks while in the bank if they choose to do so, and the bank provides face masks to customers.

In some situations, officials have closed the bank’s lobby and conducted business by appointment only, and by using the bank’s drive-through, Baugh said.

Cleaning crews come often to ensure the health of staff and customers, Baugh said.

“[We’re going to] keep the pulse on our community and take it one day at a time,” Baugh said.