By ELY NOBLE

Senior Reporter

Today a new chapter begins for the people of not just Alva, but the entire state of Oklahoma.

This date marks the first day when a 4.5% state sales tax on food is officially lifted, a move that many residents have been anticipating according to KOSU.

This change is set to have a significant impact on the wallets of everyday citizens, the state’s budget and even local businesses.

The elimination of the 4.5% state sales tax applies to most groceries, essential food items that fill the shelves of Alva’s grocery stores, items such as fresh produce, dairy products, meats and bread are included.

However, not everything in the store will be tax-free.

Prepared foods, like deli meals and hot foods, along with candy, soda and alcohol will still be taxed.

The tax break specifically targets the staples that families buy on a regular basis, making it easier for them to put food on the table without having sales taxes added to their expenses.

For the average family in Alva, this could change could mean noticeable savings over time.

For example, a family that spends $200 a week on groceries could save around $9 each or week or roughly $468 each year.

For families on a tight budget, this extra cash can be the difference in their lifestyle with inflation being at one of its peaks.

For the residents of Alva, the savings on groceries might be slightly different since local taxes are still in place.

Alva city tax will continue to be charged on food, though it is significantly lower than the state tax that is now removed.

This means that while residents won’t be paying the 4.5% state sales tax, they will see a smaller percentage taken out for city taxes.

The reduction in overall tax rates is expected to encourage more spending and could boost local businesses in unexpected ways.

Local businesses, especially groceries stores, are preparing for a surge in customers eager to take advantage of the new tax-free status of food.

Bryan Gragg, the General Manager and coach at Walmart in Alva, has already started preparing his team for what he believes will be a busier than usual period.

“I see a need for more staffing due to increase in sales,” Gragg said. “It will be both beneficial and a struggle with zero tax on food, we will see sales rise, which is always good for businesses; however, it will also cause low in stock and outs, causing a strain on supply chain.”

The increased demand could lead to challenges in keeping shelves stocked, putting additional pressure on the supply and staff to maintain a high level of service.

Oklahoma was one of only 13 states that still had taxes on most groceries.

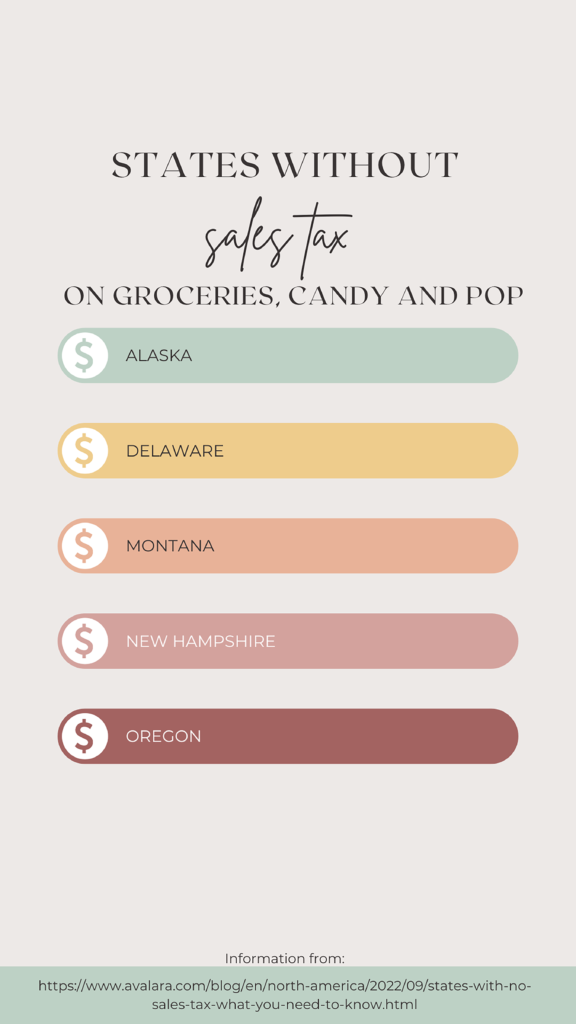

There are also five states that do not have a sales tax on groceries, pop or candy.

These include Alaska, Delaware, Montana, New Hampshire and Oregon. These states are often referred to as the NOMAD states. The state with the lowest non zero state sales tax is Colorado according to tax foundation.